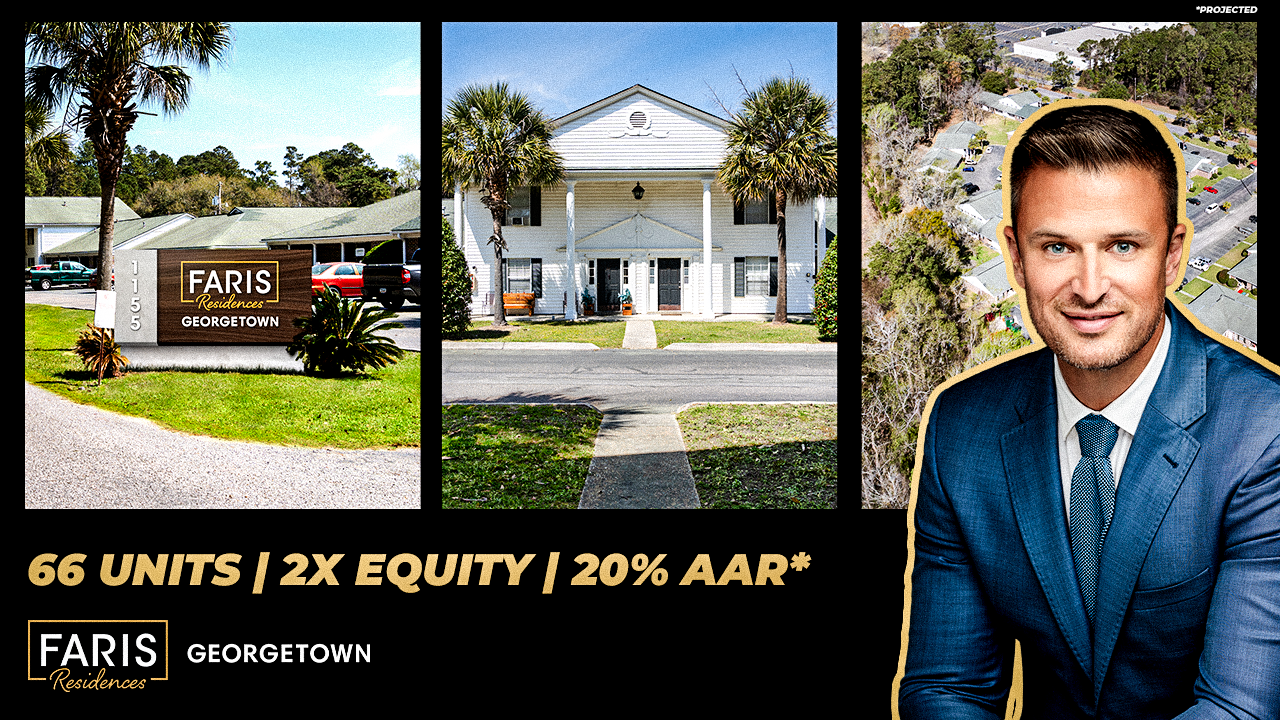

In this episode of The Multifamily Investor Playbook, Mark Faris and John Makarewicz break down why our multifamily real estate investments follow a three-to-five-year hold period — and how that timeline is a competitive advantage.

They walk through the year-by-year strategy, from stabilizing and renovating properties in the early stages to harvesting cash flow, unlocking value, and timing the optimal exit. You’ll learn how this approach maximizes returns, mitigates risk, and avoids the short-term market noise that can derail results. Whether you’re a busy professional or an experienced investor, discover how patient, disciplined investing can deliver strong, predictable outcomes — and why multifamily real estate is one of the most resilient wealth-building strategies available today.

🔔 Subscribe for more episodes from the Multifamily Investor Playbook.

📩 Want to invest with us? Visit https://fulloutinvesting.com to explore our 10-step process and current offerings.

.jpeg)